"Financial Literacy Workbook For Young Adults: 5 in 1" by Greg Middleton is the ultimate guide for young adults seeking financial independence. This comprehensive workbook demystifies complex financial concepts, breaking them down into easily digestible steps. Covering day trading, cryptocurrency, NFTs, dividend investing, and options trading, it equips readers with the essential skills to manage money effectively, eliminate debt, and build wealth. Even beginners can learn to navigate the stock market, understand digital currencies, and explore the potential of NFTs. Middleton's practical advice and strategies empower young adults to make informed financial decisions, achieve financial freedom, and create a secure future.

Review Financial Literacy Workbook For Young Adults

This "Financial Literacy Workbook For Young Adults" is a fascinating read, and my experience with it was a bit of a journey. Initially, I approached it with a healthy dose of skepticism, particularly the sections on cryptocurrency and NFTs. Coming from a generation where financial literacy meant balancing a checkbook and carefully watching your investments in established markets, the rapid-fire world of digital assets felt foreign and, frankly, a little frightening. I also had a very specific need in mind: helping my teenage daughter navigate the increasingly complex world of personal finance in the digital age.

However, as I worked my way through the book, my skepticism slowly faded. The author, Greg Middleton, does an excellent job of breaking down complex financial concepts into easily digestible chunks. What surprised me most was how he managed to connect traditional, familiar concepts like dividend investing (something I've been doing for years) with newer, more modern investment opportunities like crypto and NFTs. This bridging of the gap between established and emerging financial landscapes made the transition to understanding the digital financial world less daunting than I'd anticipated. The book didn't shy away from the risks involved in these newer areas, which I appreciated. It presented a balanced view, acknowledging the potential for high returns alongside the inherent volatility.

The inclusion of practical exercises was also a significant strength. These exercises allowed me to apply the knowledge I was gaining to my own financial experiences, helping me evaluate these new opportunities through a lens of established financial understanding. I found myself revisiting my own tried-and-true strategies and considering how I could incorporate these newer possibilities into my overall financial plan, not just for myself but also as a way to help guide my daughter. This wasn't simply about learning about money; it was about learning how to think critically about money in a rapidly changing financial environment.

While some might argue that certain topics, like day trading and options trading, are perhaps too advanced for absolute beginners, I believe their inclusion provides a broader perspective on the financial world. It exposes young adults to a wider range of opportunities and potential risks, encouraging them to approach their financial decisions with a more informed and nuanced understanding. The book isn't solely focused on these riskier ventures; it provides a comprehensive overview covering budgeting, debt management, investing, and more, which I felt was crucial for a well-rounded understanding.

The chapter on Bitcoin, in particular, stood out as an excellent primer. It clearly explained the technology behind Bitcoin, how it works, and provided a safe starting point for exploring the world of cryptocurrencies. This was instrumental in helping me understand the conversations my daughter and her friends were having, and it allowed me to contribute meaningfully to those conversations rather than just remaining confused and out of touch.

Overall, I found this workbook to be a valuable resource, not just for young adults but also for older generations looking to expand their financial knowledge and adapt to the evolving digital financial landscape. It’s a comprehensive, well-structured guide that successfully blends traditional financial wisdom with a forward-looking perspective on the exciting—and sometimes intimidating—opportunities of the modern financial world. It's not perfect, but it’s a highly effective tool for anyone wanting to build a strong financial future.

Information

- Dimensions: 7 x 0.57 x 10 inches

- Language: English

- Print length: 253

- Publication date: 2024

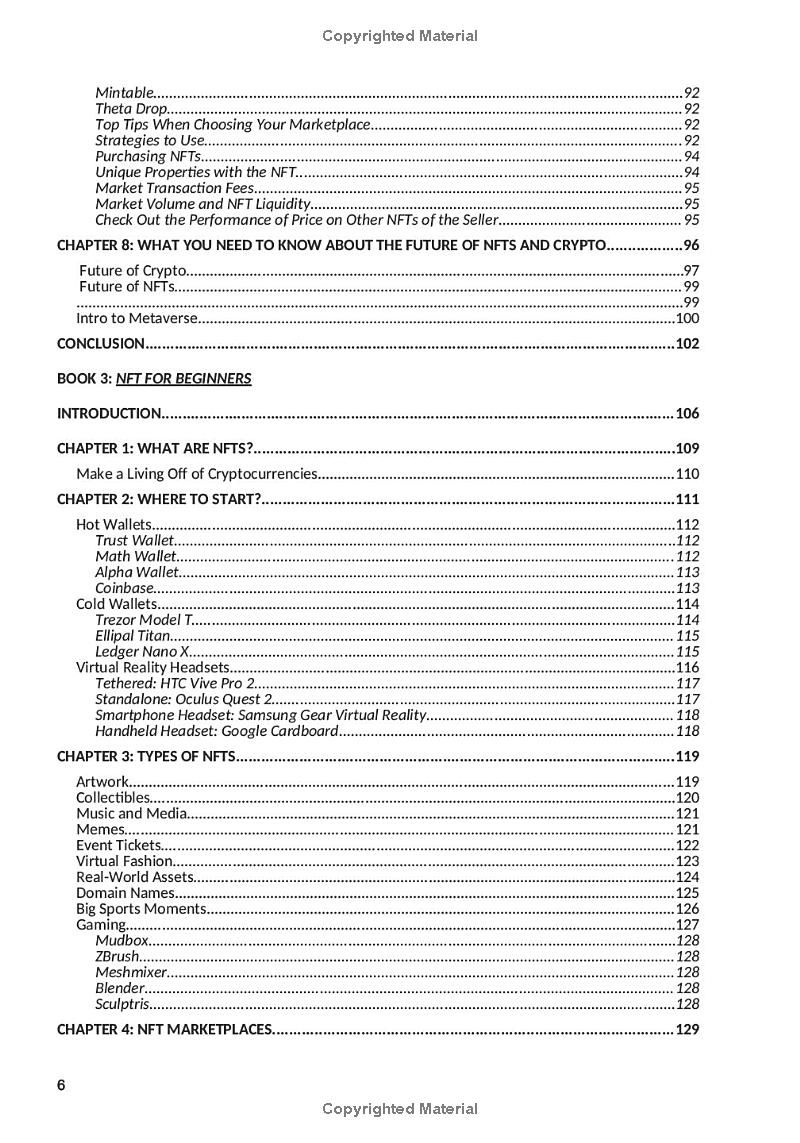

Book table of contents

- CHAPTER 3: WHAT YOU NEED TO KNOW ABOUT EXCHANGES AND BROKERS

- CHAPTER 4: WHAT YOU NEED TO KNOW ABOUT TRADING AND INVESTING FOR BEGINNERS

- CHAPTER 5: WHAT YOU NEED TO KNOW ABOUT ONLINE SECURITY, MISTAKES, AND SCAMS IN

- CHAPTER 6: WHAT YOU NEED TO KNOW ABOUT DIGITAL TOOLS

- CHAPTER 7: WHAT YOU NEED TO KNOW ABOUT THE FUTURE OF NFTS

- CHAPTER 8: WHAT YOU NEED TO KNOW ABOUT THE FUTURE OF NFTS AND CRYPTO

- Future of Crypto

- Future of NFTs

- Intro to Metaverse

- CONCLUSION.

- BOOK 3; NFTFOR BEGINNERS

- INTRODUCTION.

- CHAPTER 1: WHAT ARE NFTS?

- Make Living Off of Cryptocurrencies:

- CHAPTER 2: WHERE TO START? .

Preview Book